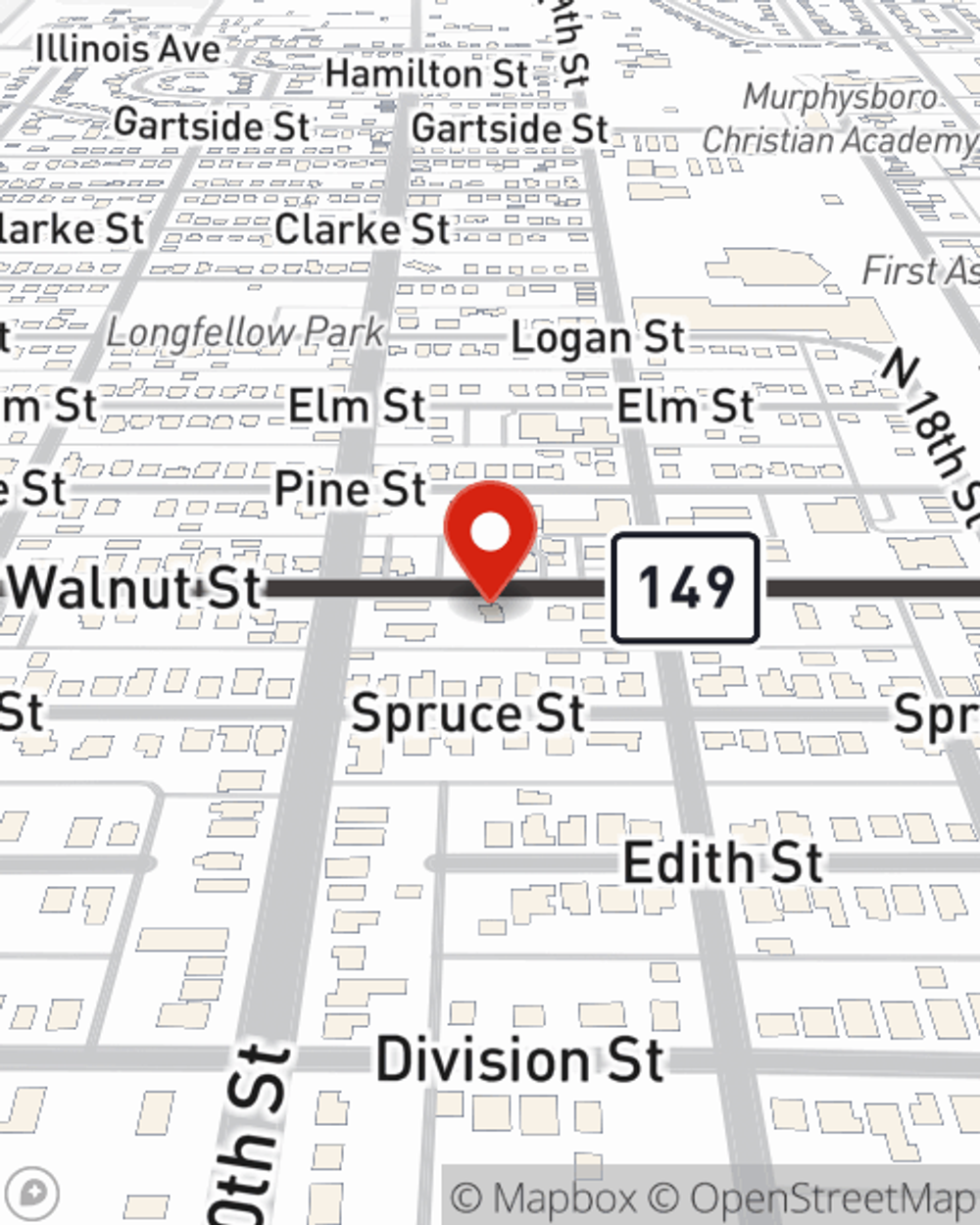

Business Insurance in and around Murphysboro

Get your Murphysboro business covered, right here!

This small business insurance is not risky

- Carbondale

- Carterville

- Grand Tower

- Gorham

- Jackson County

- Marion

- Pinckneyville

- Ava

- Campbell Hill

- Anna

- Cobden

- Alto Pass

- Pomona

- Desoto

- DuQuoin

- Makanda

- Vergennes

- Herrin

- Hurst

- Dowell

Cost Effective Insurance For Your Business.

Do you own an insurance agency, a HVAC company or a lawn care service? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on your next steps.

Get your Murphysboro business covered, right here!

This small business insurance is not risky

Small Business Insurance You Can Count On

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, commercial liability umbrella policies or business owners policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Chris Mueller is here to help you identify your options. Call or email today!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Chris Mueller

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.